It’s high time we address critical gaps in our development strategies

Rural households continue to experience hardships in terms of income, savings and financial literacy

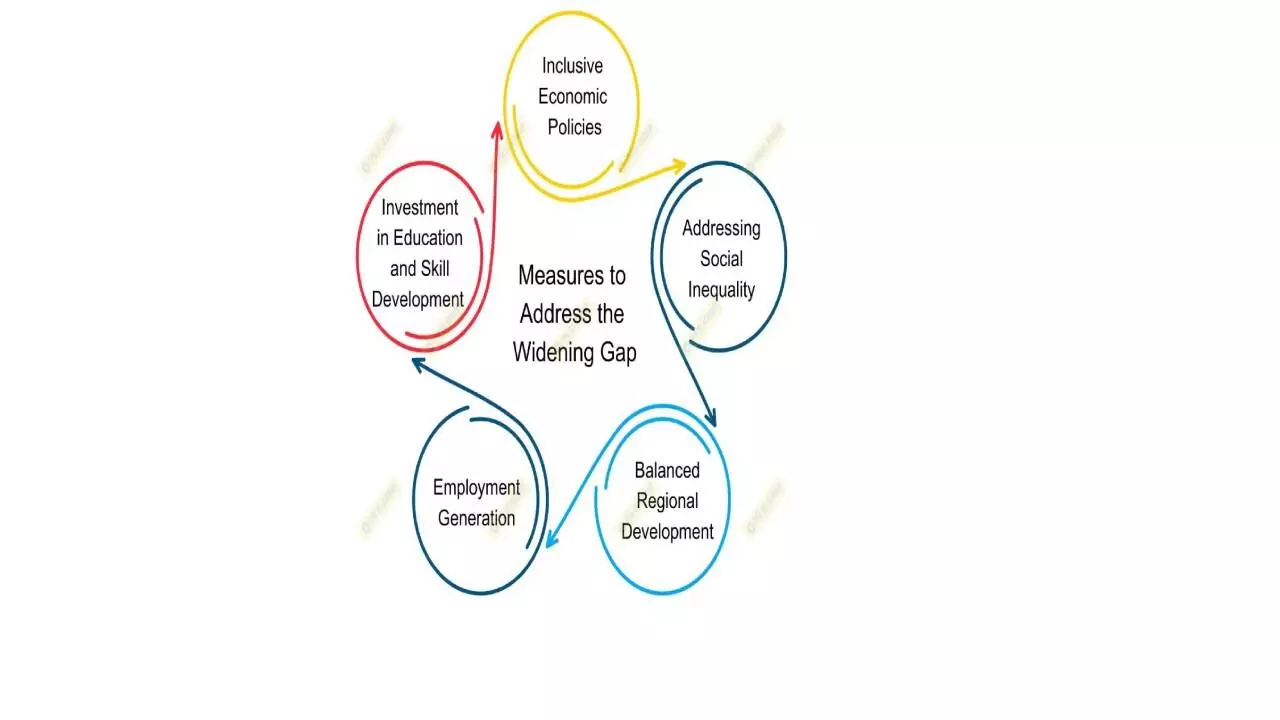

image for illustrative purpose

The ultimate goal of development is to make people’s life easier and better in general and that of the marginalized sections in particular. A well-crafted governance policy will strive to create an inclusive environment where the quality of life is enhanced for all sections of the society. It focuses on improving living standards for all and particularly for marginalized sections as they often face systemic barriers. Thus, holistic development aims to uplift disadvantaged communities, empower them, and promote social justice, leading to a more equitable and prosperous society where everyone can thrive.

However, a survey done by the National Bank for Agriculture and Rural Development (NABARD) points to serious lapses in our growth strategies. NABARD on October 9 released the results of its second All India Rural Financial Inclusion Survey (NAFIS) 2021-22, providing primary survey-based information relating to one lakh rural households on several economic and financial indicators for the post-Covid period. Realizing the critical importance of financial inclusion for growth and economic development, NABARD had conducted the first such survey for the agricultural year (July-June) 2016-17, the results of which were released in August 2018.

The findings of NAFIS 2021-22 will help us in assessing how different economic and financial indicators of development in rural areas have changed since 2016-17. According to the survey, the average monthly income of households increased by 57.6 per cent during the five-year period from Rs. 8,059 in 2016-17 to Rs. 12,698 in 2021-22, suggesting a nominal compound annual growth rate (CAGR) of 9.5 per cent.

The question that arises: Is this much increase in the income of a household enough to cope with skyrocketing costs of living and ensure quality health and education facilities for their children? Certainly, not, as the average monthly expenditure of households also increased during the five-year period from Rs. 6,646 in 2016-17 to Rs. 11,262 in 2021-22, not much left to be saved.

As per the survey, the share of food in the consumption basket of households declined from 51 per cent in 2016-17 to 47 per cent in 2021-22. The annual average financial savings made by households increased to Rs. 13,209 in 2021-22 from Rs 9,104 in 2016-17. Approximately, 66 per cent of households reported that they have saved in 2021-22, as against 50.6 per cent in 2016-17. The proportion of households who reported to have outstanding debt moved up from 47.4 per cent in 2016-17 to 52 per cent in 2021-22. Similarly, the proportion of agricultural households that took loans from institutional sources only increased from 60.5 per cent in 2016-17 to 75.5 per cent in 2021-22, while the corresponding increase for non-agri households was from 56.7 per cent in 2016-17 to 72.7 per cent in 2021-22. The proportion of agri-households that took loans from non-institutional sources decreased from 30.3 per cent in 2016-17 to 23.4 per cent in 2021-22.

The survey has also found that the proportion of households with at least one member having any type of insurance increased from 25.5 per cent in 2016-17 to 80.3 per cent in 2021-22. The proportion of households with at least one member receiving any type of pension - old age, family, retirement and disability - increased from 18.9 per cent in 2016-17 to 23.5 per cent in 2021-22. The proportion of respondents indicating good financial literacy increased by 17 percentage points, i.e., from 33.9 per cent in 2016-17 to 51.3 per cent in 2021-22. The survey also pointed out that the average size of landholding declined from 1.08 hectare in 2016-17 to 0.74 hectare in 2021-22. Thus, NAFIS 2021-22 results puncture the much-hyped claims about remarkable strides made in rural financial inclusion since the last survey in 2016-17.

Rural households continue to experience notable hardships in terms of income, savings, insurance coverage, and financial literacy.

According to the Economic Survey 2022-23 tabled in Parliament on January 31, 2023, 65 per cent of the country’s population lives in the rural areas and 47 per cent of the population is dependent on agriculture for livelihood. Therefore, the focus on rural development is imperative. Multifaceted efforts must be made to improve the quality of life in rural areas to ensure more equitable and inclusive development. Transforming lives and livelihoods through proactive socio-economic inclusion, integration, and empowerment of rural India must not be a slogan but an article of faith for the powers-that-be.

I would also recommend rigorous auditing of outcome-oriented statistics to ensure tangible medium and long run progress in rural living standards, aided by the policy focus on basic amenities and efficient programme implementation.

The impact assessment of welfare schemes like Pradhan Mantri Kisan Samman Nidhi, Pradhan Mantri Kisan Maan Dhan Yojana, MGNREGS, PMAY-G, PMGSY, Deendayal Antyodaya Yojana-National Rural Livelihoods Mission (DAY NRLM), Deendayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY) at the ground level is the need of the hour. It must be ensured that our welfare and affirmative measures do not turn out to be paper-tigers, but make significant contributions to improving the lives of the rural population. We need to know if investments in rural development are in sync with the magnitude of the problems or not.

If that is not done, our struggle for a more prosperous and financially secure future for India’s rural population will become more agonizing in years to come, as despite nearly 80 years of independence, large segments of the rural population continue to face backwardness in terms of education, healthcare, infrastructure, and economic opportunities.

A comprehensive approach to rural development will help in addressing interconnected issues simultaneously, ensuring that growth is inclusive and sustainable. It should involve enhancing agricultural productivity, providing skill development programmes, improving access to quality education and healthcare, and building essential infrastructure such as roads, clean water, and sanitation facilities. If we empower rural communities and improve their quality of life, we will not only bridge the urban-rural divide but will also strengthen the nation’s overall economic and social fabric, driving India toward equitable progress and prosperity.

(The writer is a senior journalist, author and columnist. The views expressed are strictly his personal)